|

Japan:

Rebuilding After the Bubble

Japan

Map

Japan/China

Map

I.

The Environment

A.

Little land or resources—trade dependency

B.

Crazy-Strong Work Ethic

1.

Past refrain: "We must work very hard because we are a poor

island nation." A newer Japanese term, karo shi, was

coined to mean "death by overwork," and now

families are compensated by both the government and the

employer for these deaths.

2.

Recent efforts to moderate work ethic:

Reduced

the length of the standard legal workweek from 48 to 44, and

then to 40 hours. Employees who work more hours are supposed

to be paid overtime, and there's a legal cap on how many hours

can be worked overtime. On the positive side, some firms are

shifting to a 4-day

work week to encourage employees to go home, and some

are turning off their lights at night. In

June 2018, the government passed a new labor law that

limits overtime to 100 hours per month (a lot!), but included

a loophole that allows white-collar workers to exempt

themselves from that limit.

However, at many firms, staying within legal limits is

considered a form of "disloyalty," and workers find ways

around those limits -- for example, by working without

clocking in. According to BBC,

"Nearly a quarter of Japanese companies have employees working

more than 80 hours overtime a month, often unpaid, a recent

survey found. And 12% have employees breaking the 100 hours a

month mark."

C.

Hierarchical social structure, groupism, and culture of

conformity, perhaps descended from Confucianism – a

hierarchy of family structures from the nuclear family up

to the old "Japan Inc."

D.

Poor Status of Women– According to the World

Economic Forum index, Japan ranks 121st in the world -

behind China (106), India (112), and the United Arab Emirates

(120) - in gender equality. Women hold only 5% of seats on company

boards, compared to 22% in the U.S. and more than 40% in

France, Iceland, and Norway. The current controversy is the #KuToo

movement, protesting rules that require women to wear

high heels at work - even in some assembly-line jobs.

C.

Political instability--seven prime ministers served during

1990s, and seven served during 2000-2012. Some stability

restored when Shinzō Abe served from 2012-2020, making him the

longest-serving Prime Minister in Japanese history, but then

he was assassinated in 2022 while speaking at a political

event. His successor, Yoshihide Suga, served only from

2020-2021, and now the prime minister is Fumio Kishida, a

former Minister of Foreign Affairs who lived in the U.S.

during part of his childhood.

II. A

Brief History

A.

Tokugawa era (1603) - Military

dictatorship brought peace, law, order, and isolation.

In 1853, Commodore Perry demanded opening trade

relations.

B.

Meiji reforms (1868) - Opened

the door to foreign trade, equality of classes, eliminated

feudal guilds, divided agricultural estates among the

peasants, instituted monetary taxes, and established

businesses and supported private industry through loans and

subsidies. Growth continued until 1938 and World War II.

C.

World War II - Destroyed 1/4 of

buildings and 1/3 of industrial machinery. Japan was not

surrounded by other countries with expanding markets; recovery

initially slow. U.S. occupation forces initially had little

interest or expectation in quick recovery.

D.

Korean and Vietnam Wars -

Increased demand for Japanese exports and caused the U.S. to

see Japan as an important ally.

III.

The Economic Growth Miracle

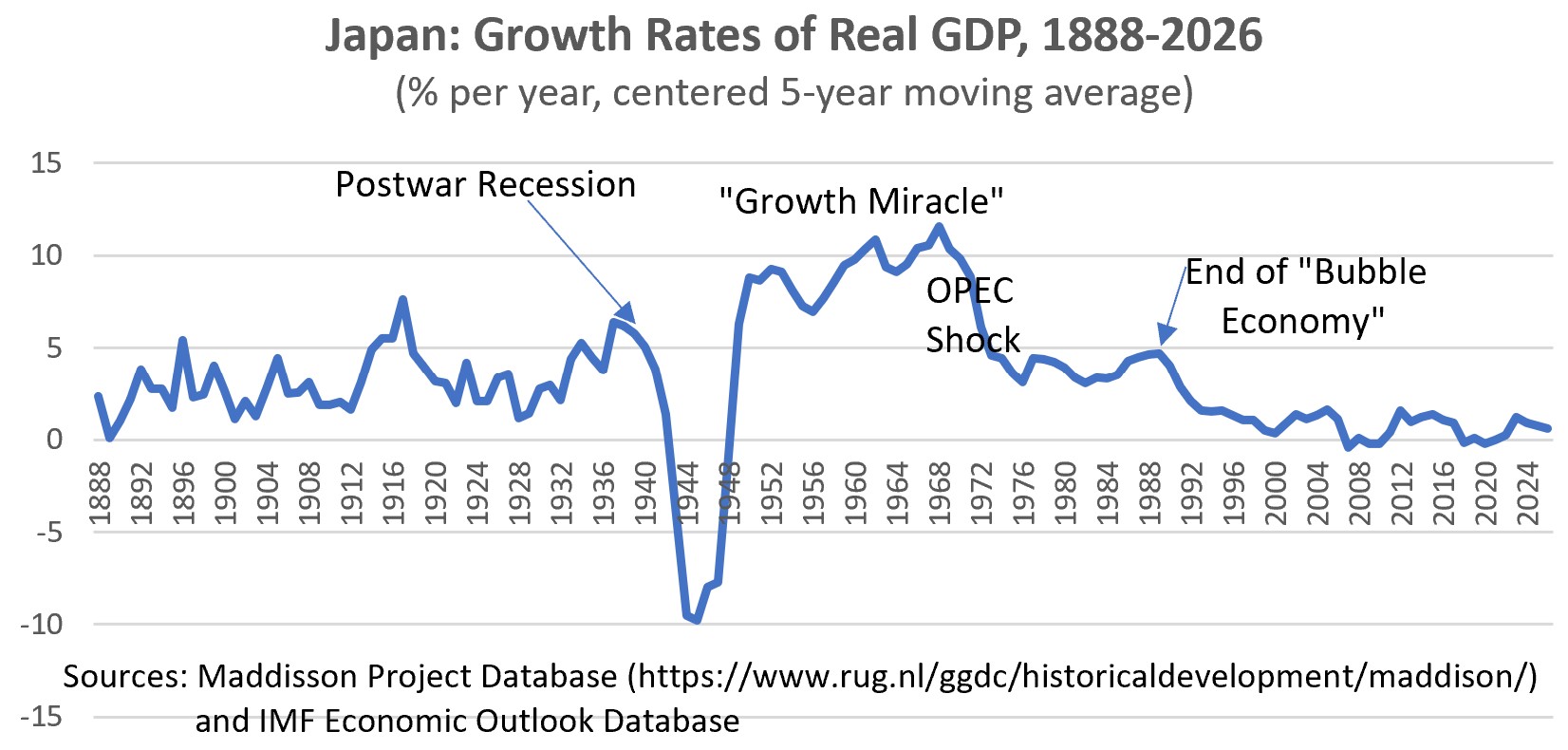

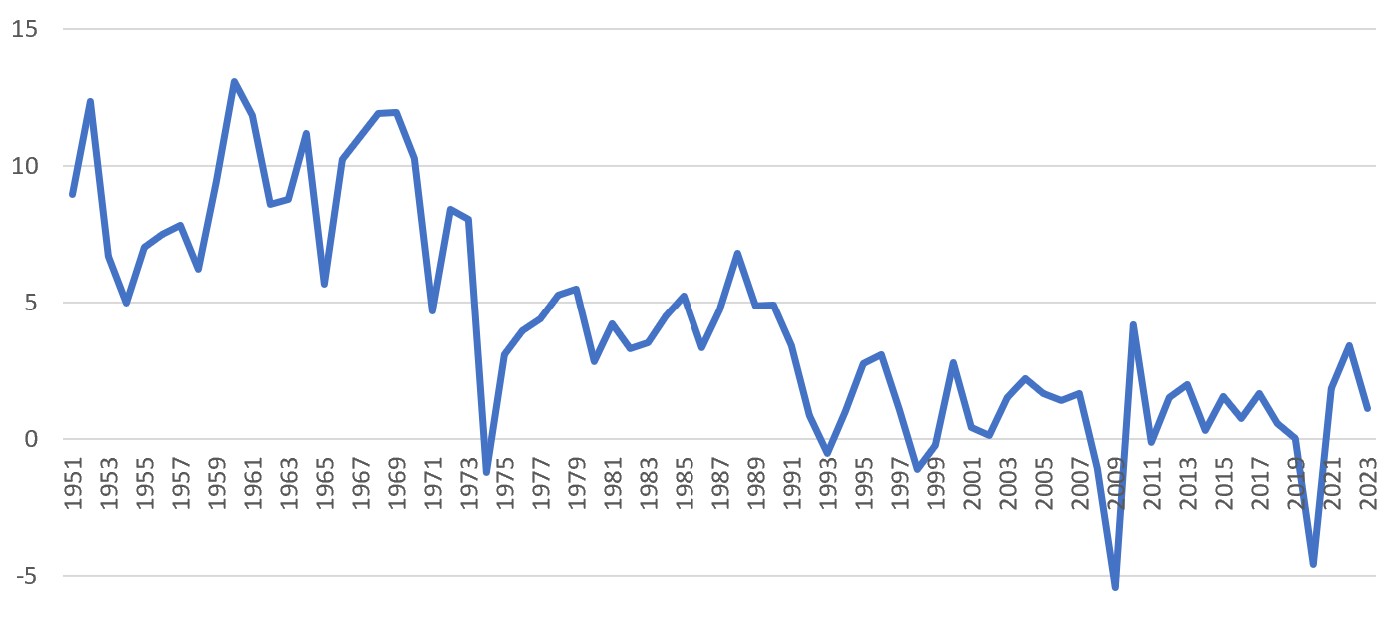

From

1956 until the oil shocks that began in 1973, the Japanese

economy grew at a rate of about 10%/year. According to

econometric estimates, these were the major contributors:

A.

Growth of capital stock - The

largest contribution to growth, supported by saving rate.

B.

Technology - 2nd ranking cause of

growth was the contribution of knowledge and technology to

factor productivity. Facilitated by the adoption of foreign

technology.

C.

Labor - Growth in the quantity,

working hours, and educational quality of labor was the third

primary source of growth. Low unemployment was promoted

by the permanent commitment system and flexible bonus income.

IV.

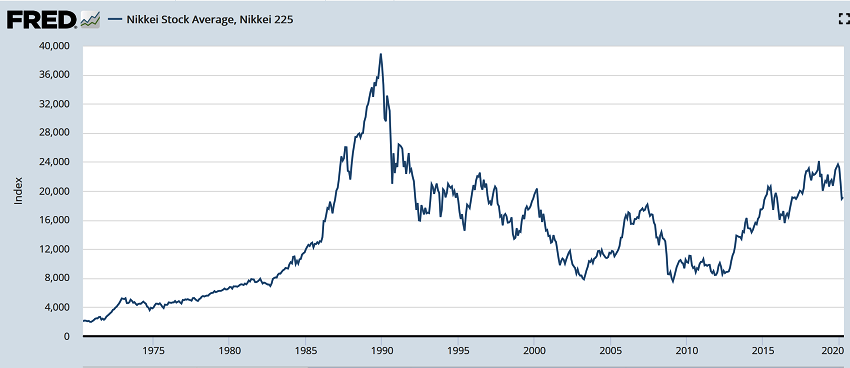

The Bubble Economy

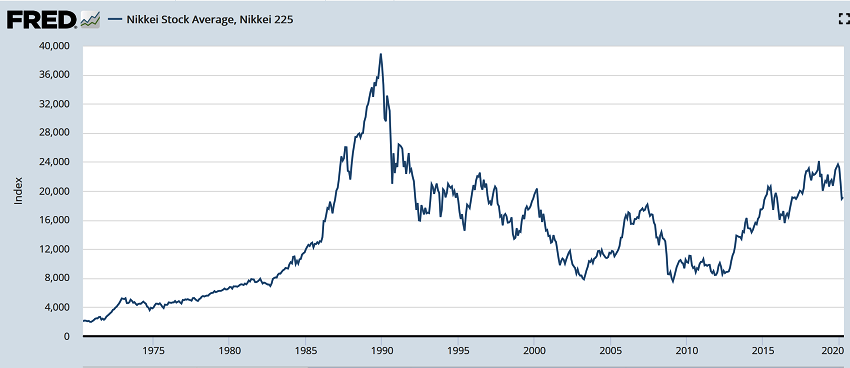

Early

1980s -- Japanese growth was discouraged by U.S.

recession

1983-84

–U.S. recovers, Japan soars, but with trade imbalance.

1985

--

Plaza Accord -- Japan

accepts large appreciation of the yen, compensating for slow

export growth with expansionary monetary policy. Easy money

triggered speculative

bubble economy, with

rising real estate and

stock

prices.

May

1989 -- Bank of Japan shifts to more restrictive

monetary stance, causing bubble to burst. During 1989-1996,

real estate and stock prices both fell by about 50 percent.

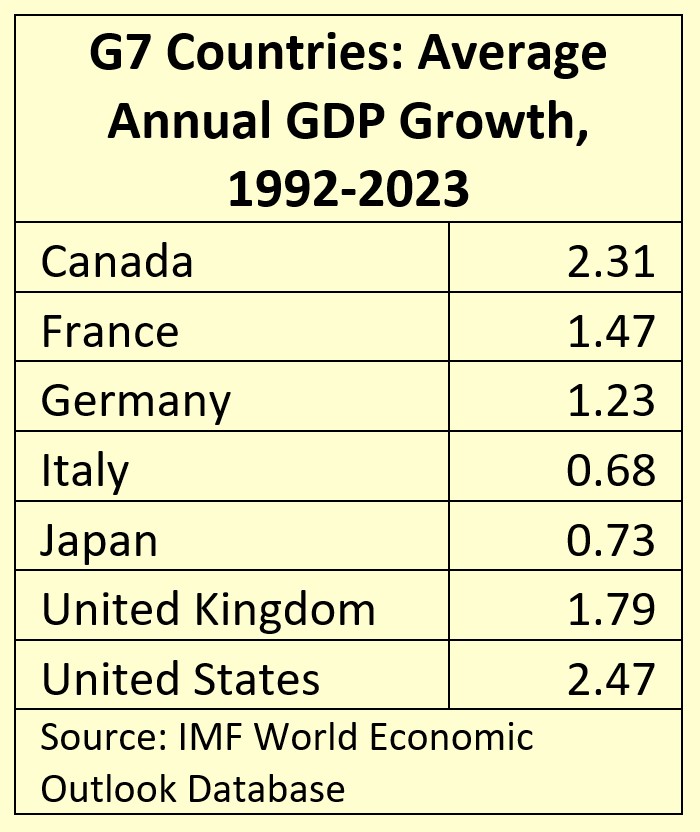

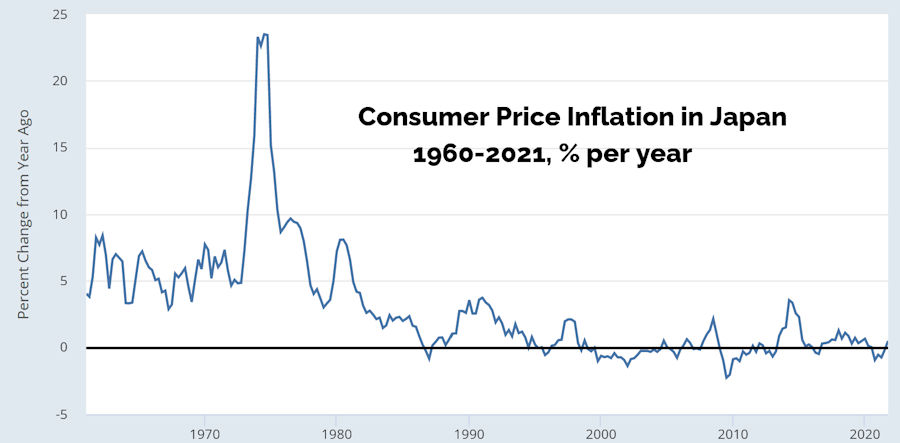

1992-2023

– Average annual GDP growth of only 0.73% - among G7

countries, only Italy had a lower growth performance. Deflation

started around 1999 and has recurred during many years.

Source: OECD from FRED database (online)

December

2012

-- Shinzo Abe became Prime Minister and introduced

"Abenomics," characterized by "three arrows:" 1. Pressuring

the Bank of Japan to launch aggressive monetary easing with a

target of 2% inflation to support 2% real GDP growth; 2.

Deficit-financed supplemental government budget with new

public works spending; and 3. A program of structural reforms

to achieve growth through stimulating private investment.

However, the Ministry of Finance failed to follow a vigorous

fiscal policy, and structural reforms moved slowly. So

the main policy instrument was a late-in-the-game expansionary

monetary policy that pushed inflation above 2% in 2014, but

then it fell below 1% again afterward.

NOTE: The Japanese experience with deflation

had a major impact on the U.S. response to the 2007-2010 Great

Recession. See Ben Bernanke's

2002 speech, "Deflation: Making Sure 'It' Doesn't Happen

Here": high real interest rates, high cost of repayment in

valuable money, delayed purchases, complication of monetary

policy.

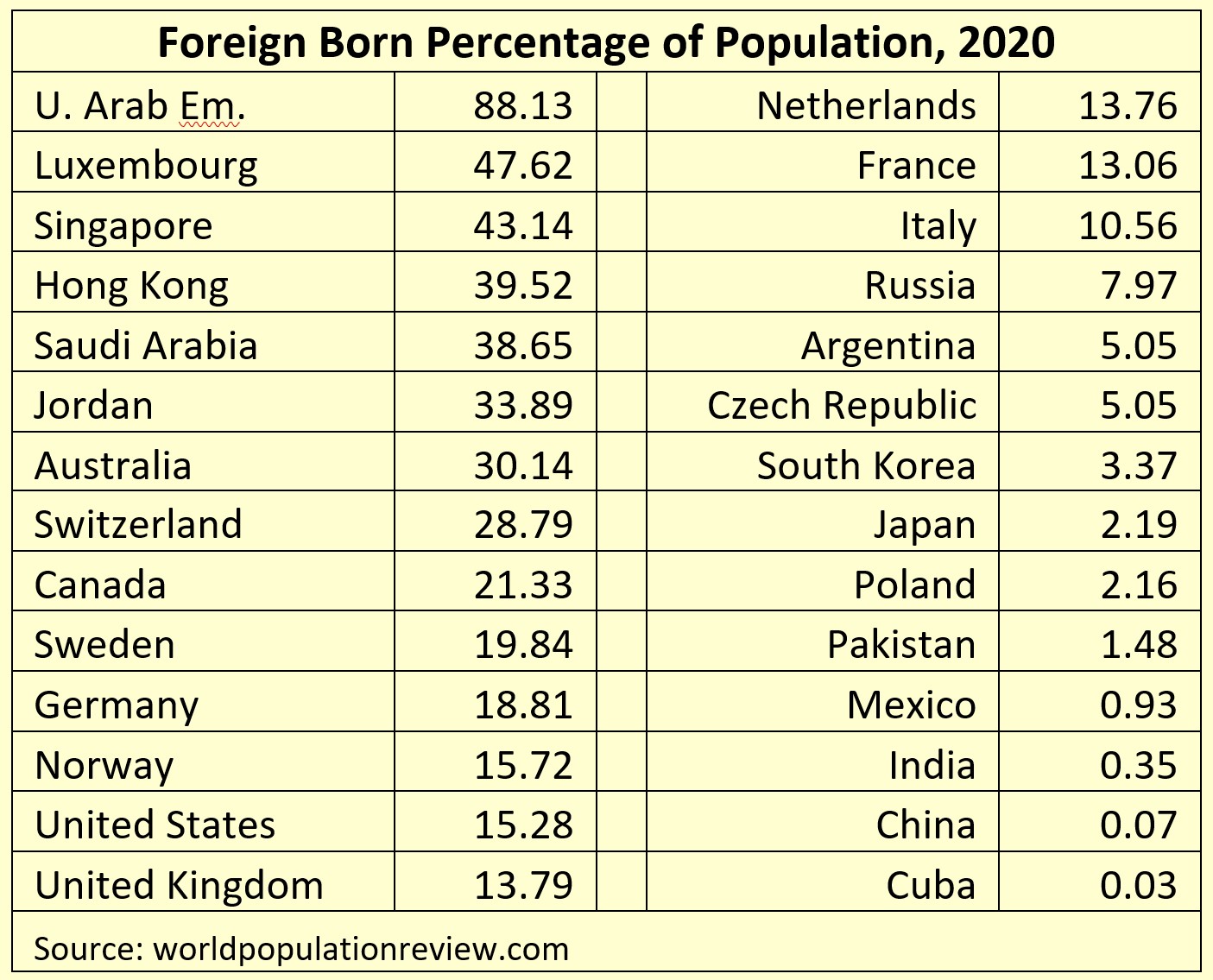

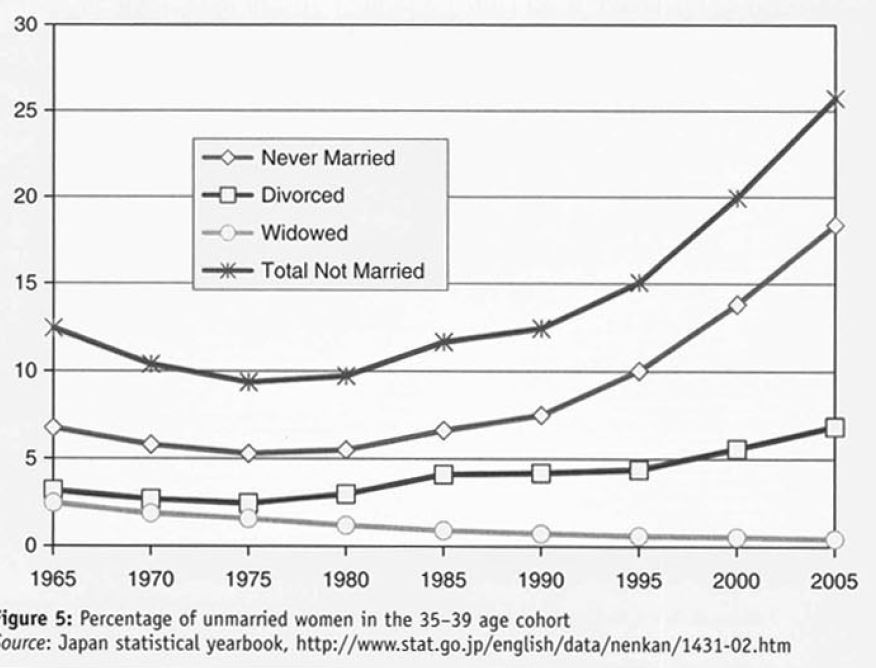

Along with deflation, the declining

population in Japan (currently falling by 400,000 per

year), caused by low fertility and marriage rates and

unwillingness to accept foreign workers, have been considered

major causes of declining economic growth.

Japan: Annual Growth of GDP

1951-2023 (%)

(actual and forecast)

Source: Penn World Tables and OECD Economic Outlook, December

2021

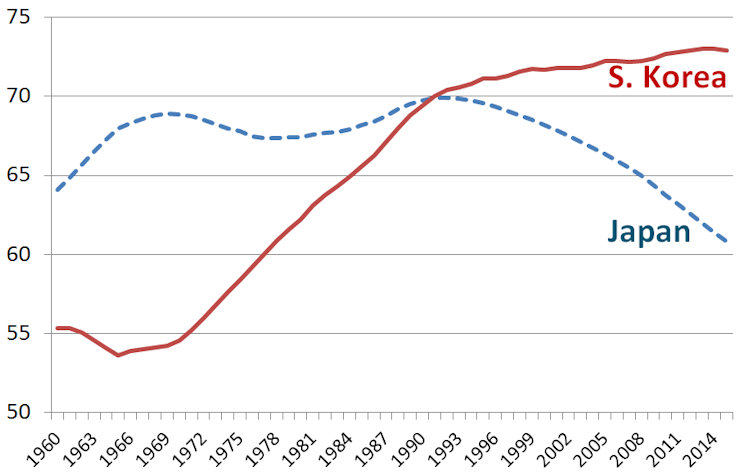

Japan

and S. Korea: Working Age

(15-64) Share of Population

Unmarried

Women in Japan, 1965-2005

Japan

Population Forecasts

V.

Industrial Organization

A.

Big Business

1.

Zaibatsu - Family-owned holding

company controlled shares in a diversified group of industrial

corporations, trading companies, and banks. After the

war, American-written anti-trust legislation dissolved holding

companies.

2.

Keiretsu - Created after WWII,

these groups usually involve cross holdings of stock,

interlocking directorates, presidents' clubs, and other

cooperative arrangements.

a.

financial keiretsu -- Mitsui,

Mitsubishi, and Sumitomo, which were formed by regrouping

former zaibatsus, plus Fuyo (or

Fuji), Sanwa, and Dai-Ichi Kangyo—include manufacturing firms

and also banks, insurance companies, and trading companies.

b.

production

keiretsu – a large industrial concern and its

subsidiaries and subcontractors, with tight, stable

relationships, such as Toyota. Able to use just-in-time (kanban) system, shifting the

inventory cost to subcontractors.

c.

distribution

keiretsu -- exclusive organization that moves

products from manufacturers to consumers. Operating like

networks of company-controlled auto dealerships in the United

States, these are found in the automotive, cosmetic,

electrical, and electronic sectors in Japan.

3.

Results -- Japanese companies apparently did not join keiretsu

groups to earn monopoly profits, but to provide the security

and stability of a family relationship. [UPDATE]With

rising competition since the rise of China, that security

system has broken down. According to Forbes:

"The keiretsu system reached its peak in 1988 when 55% of all

floated TSE stock was held in keiretsu cross-shareholdings.

However, as Japan’s economic fortunes declined in the 1990s,

cracks began to appear and both the cross-shareholdings and

the keiretsu system began to unwind. Eventually, the keiretsu

began to diversify their supply chains and source extensively

from China and Southeast Asia."

Some of them, for example, are now supplying Apple for the

iPhone: "More than 700 companies are involved in the

manufacture of an iPhone, and unsurprisingly about half (349)

of these companies are in China. In second place, however, is

Japan with 139 firms, followed by the U.S. with 90."

While the old keiretsu system has yielded to foreign

competition, other recent

research suggests that a new, more flexible and

competitive keiretsu system has arisen. "Over the past two

decades Toyota’s suppliers’ association (kyohokai) has

remained quite stable: From 1991 to 2011 fewer than 20 of

about 200 companies withdrew. From 1991 to 2010 the average

sales-dependence ratio (the revenue from Toyota-related

business as a share of total revenue) of 44 of the company’s

suppliers has remained about 80%, even as Toyota has expanded

its sourcing pool."

B.

Small Business - 99% of Japanese

companies, employing 75% of work force, employ fewer than 100

workers.

1.

Subcontractors - 2/3 of small

firms in manufacturing. Large firms shift the cost of

holding inventories to subcontractors, and maintain their

"permanent commitment" employment by adjusting the use of

subcontracting.

2.

Retail stores - Average

store has only 4 employees. Remained small because of limited

auto ownership and bureaucratic obstacles.

VI.

Labor Market and Labor

Relations

A.

Collective Bargaining

1.

Unions - Comprehensive

enterprise-based unions, affiliated with industrial, regional,

and national federations. Labor-management disputes are

generally kept within family companies.

2.

Spring Labor Offensive -

December/January, labor federations target basic wage

increases. April, unions stage brief strikes and

demonstrations. Coordinated negotiations between

national labor and employer confederations.

B.

Lifetime Employment

1.

Coverage - Male employees in

larger corporations. About 25-30 percent of labor

force. During the 1990s, the proportion of long-tenure

(10-year plus) workers was 43% in Japan, compared to 26% in

the U.S. Women historically excluded--until recently,

participation rate during early marriage dipped below

50%. It still dips, but not as deeply, and overall

female participation has risen above U.S. levels:

Source: International Labor

Organization ILOSTAT database

2.

Benefits

a. Security and loyalty of workers who are

covered.

b. May contribute to adoption of technology

because workers have little fear of technological unemployment

and employers know their company will benefit from training.

3.

Problems -

a.

To employers--redundant, incompetent, unmotivated workers

retained, sometimes in meaningless jobs.

b.

To young employees--difficult to leave for a more attractive

job.

c.

To older employees and workers not included in system--

greater job uncertainty.

d.

For these and other reasons, the conventional wisdom has

suggested that the system was in decline, but 2015

research by Japanese authors suggested that it has changed

very little while employment has grown more insecure in

the U.S.

UPDATE:

Wall Street Journal, 4/11/2018: More people are

switching careers at for new opportunities, and more companies

are willing to hire them because of scarce talent, however:

"many companies resist the idea of midcareer job-switching...

The number of employees switching jobs annually is still less

than 5% of the Japanese workforce. In 2016, the average worker

in Japan had been at one company for about 12 years, compared

with an average 8.6 years in the U.K., according to official

data. The U.S. Bureau of Labor Statistics doesn't report

average employee tenure, but the median U.S. figure was 4.2

years in 2016. "Employees will see their salary more than

double if they continue working for 20 years, so they don't

have the incentive to think about changing jobs," said Ryo

Kambayashi of Hitotsubashi University. .

C.

Seniority Pay - Wages are

determined largely by the length of service of the

employee. Reinforces employee interest in lifetime

employment, but reduces employer interest. System is in

decline.

D.

Bonuses - Account for 20% of pay

in manufacturing. Significance:

1.

Employee motivation.

2.

Saving - If the bonuses are

regarded as transitory income, permanent income hypothesis

suggests that a large portion of the bonus income will be

saved.

3.

"Share Economy" - Weitzman

claims that bonus system explains low Japanese

unemployment. In share economy, profit maximizing

employers would expand employment and output until "every

qualified person" has a job. Critics say that bonuses are

negotiated in advance, so they aren’t true share contracts,

and that Weitzman's theory cannot explain the Great Depression

and takes little account of expectations or uncertainty.

VII.

The Financial Sector

A.

Ministry of Finance (MOF)

-- exceptionally broad authority, including influence over

fiscal and monetary policy and informal

administrative

guidance

of financial institutions. Reformers wish to reduce its power.

B.

Bank of Japan

-- central bank, led by seven-member Policy Board, is formally

independent, but informally subject to the MOF. Because

securities markets developed slowly, the Bank uses discount

lending, rather than open market operations, as its primary

tool, and uses it to support industrial policy through moral

suasion, or window

guidance,

of banks.

C.

Commercial banks –

provide large share of company financing, again, because

of limited securities market.

1.

City

banks

-- among most powerful financial institutions in the nation,

with nationwide branches. Serve large and upper-middle-sized

corporations.

2.

Regional banks --

branches in single city or prefecture. Serve small and

lower-middle-sized companies.

D.

Long-term credit banks -- underwrite securities and

finance fixed capital investments

VIII.

The Government

A.

Views of Governmental Role

1.

Conservatives - Point to conventional measures of government

influence, such as taxation, and claim that the Japanese

success was based on a limited government.

2.

Japan, Inc. - Government is "corporate headquarters" where

policy is planned and investment decisions are made.

Understates the influence of the business community on the

government.

B.

Economic Planning - The Economic

Planning Agency solicited proposals from business, labor,

government, and academia. It provided information and

improved communication between all segments of the

economy. Adherence was voluntary. Targets were exceeded

in 1960s and during the Bubble era, but underfulfilled in

1970s and 1990s. In 2001, the Economic Planning Agency

was merged into a new Cabinet Office, and particularly its

Council on Economic and Fiscal Policy, that serves as a "brain

trust" for the Prime Minister.

C.

Industrial Policy - Administered

(far less aggressively than in the past) by Ministry

of Economy Trade and Industry (the former Ministry of

International Trade and Industry. Designates industries for

priority development based on growth potential and

contribution to growth of other sectors.

1.

Proponents - Japanese success required governmental direction,

support, and socialization of risk.

2.

Critics - Japan succeeded in spite of industrial policy.

MITI picked corporations like Sony and Honda as

"losers". MITI is not as powerful as it seems. Tax

concessions are not as important in a system of low tax

burdens and only a small portion of industrial investment is

financed by government money. In recent years, pressure

has mounted for deregulation and less cronyism.

D.

Fiscal, Monetary, and Trade Policy

- Monetary and fiscal policy are normally directed by Ministry

of Finance. Budget approved by the cabinet and the

Diet. Monetary policy is executed by the Bank of Japan,

and has generally been accommodative.

E.

Redistribution of Income -- Rapid

economic growth caused property income to rise rapidly,

causing income some inequality. However, the World Bank

estimate of the Gini coefficient for Japan is a relatively

egalitarian 33%- similar to those for France and Germany.

Perhaps explained in part by a cultural norm against high

executive pay. Median compensation for U.S. CEOs is 9

times larger than for Japanese CEOs.

1.

Taxation - Has a relatively small

role in income redistribution. Personal tax rates are

highly progressive, an unusually large proportion of tax

receipts come from business profit taxes, and a small

proportion comes from the regressive consumption tax.

Furthermore, the overall tax burden is relatively light.

2.

Transfers - Traditionally, the

government paid relatively little attention to income

redistribution because families and businesses took care of

their own. That changed dramatically with social welfare

expenditures related to the Covid crisis and rising Social

Security costs for the aging population.

|