|

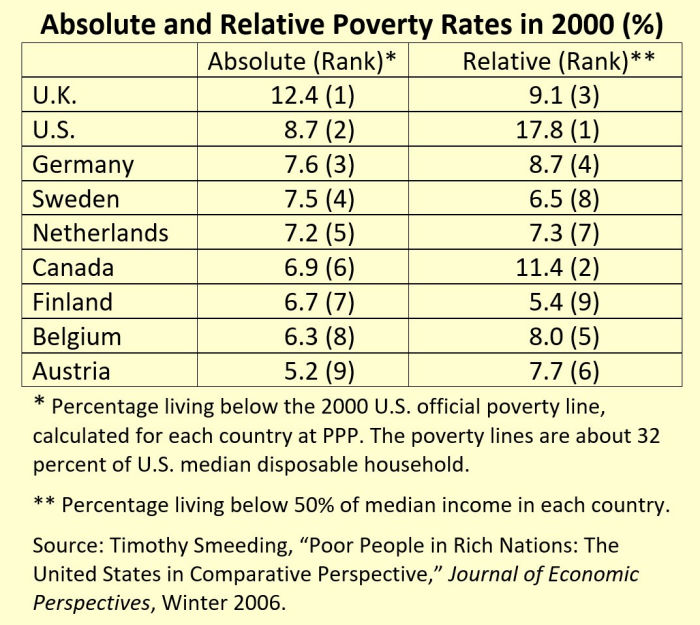

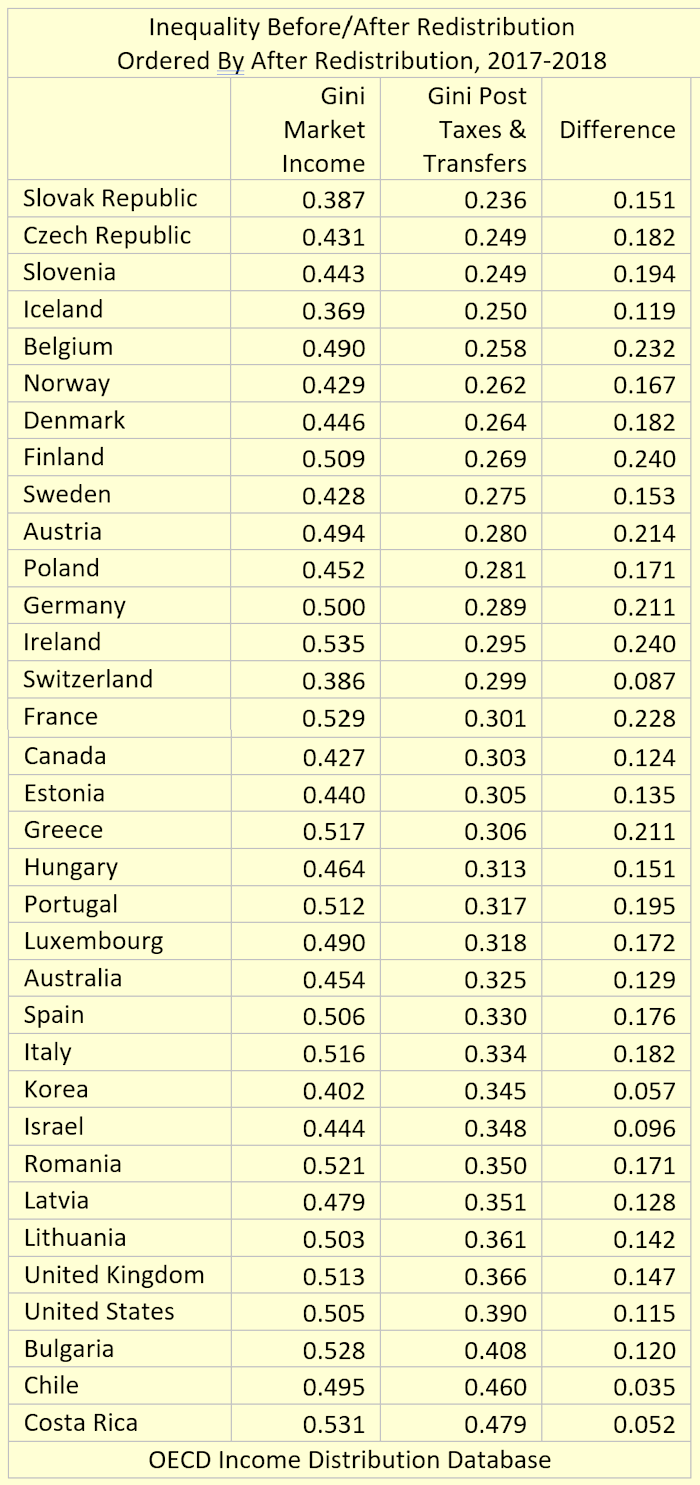

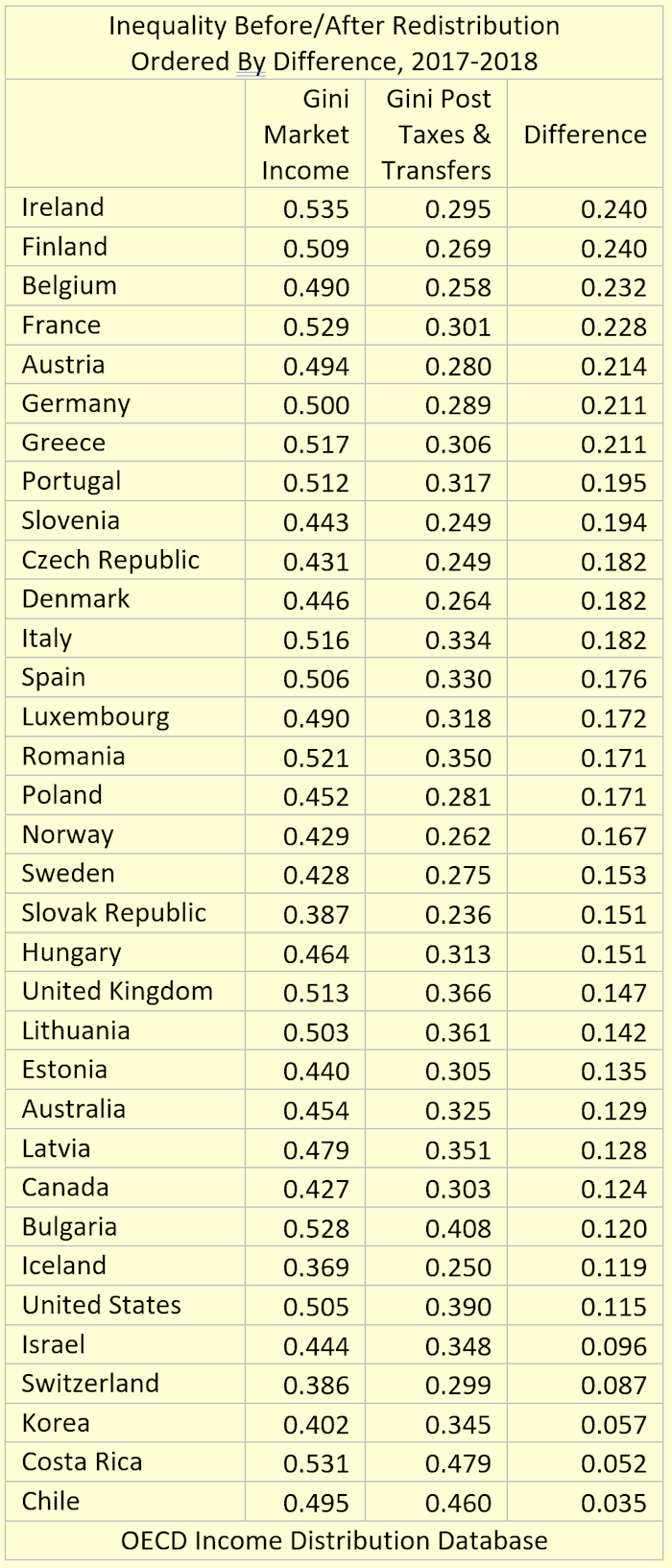

COMPARATIVE ECONOMIC STATISTICS: I. Income Distribution Comparisons--equality versus equityA. Measures of Income Inequality1. Decile ratio - the share of income received by the richest tenth of the population divided by the share received by the poorest tenth.2. Lorenz Curves - Illustrates the percentage of income received by cumulative percentages of the population. (See this web site).3. Gini ratio - Equal to the measured area between the diagonal line of equality and the Lorenz curve, divided by the area of the triangle under the line of equality.4. Poverty rate - The percentage of the population living below a level of income that provides for basic needsB. Problems in Making Income Distribution Comparisons -1. Coverage of the population - data that cover only employed persons or workers will indicate greater equality than data that include retired persons or the unemployed2. Segmentation of the population - Distribution of income among households can be different from the distribution of income among families or individuals.3. Definition of income - Only wages? Capital gains? Before or after taxes? Including transfers? Based on consumption patterns rather than income?C. Luxembourg Income Study and OECD Income Distribution Database - National reporting of income and wealth data make it possible to make comparisons with consistent definitions and coverage and to explore the impact of taxation and social expenditure policies.

Inequality Indices in 2010 Based on the

These are World Bank estimates. According to estimates in the article, "Income Inequality in Today’s China," by Yu Xie and Xiang Zhou in PNAS, April 28, 2014, the Gini ratio for China is much higher - about 52%.

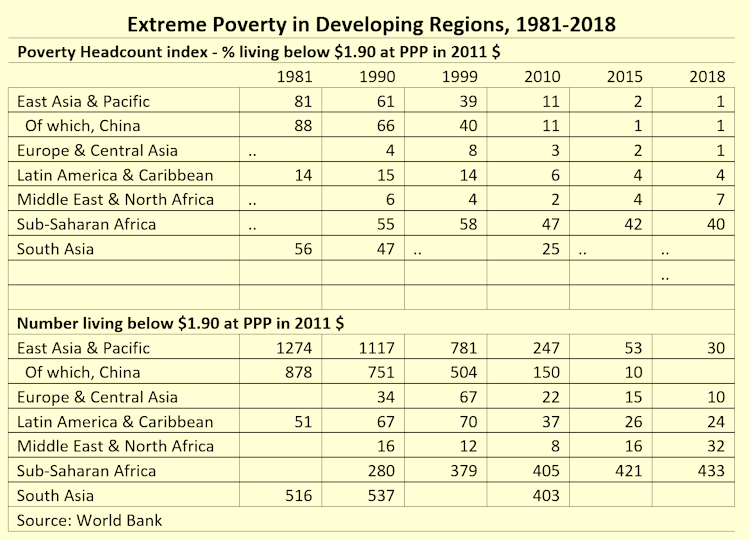

World Bank projections indicate that the gains of recent decades are being reversed strongly by the COVID-19 pandemic.

II. Wealth Distribution Comparisons

A. Generally

much more unequal than income because wealth is

cumulative.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||