The United Kingdom:

Declining Capitalism

I. Relative Economic

Decline - U.K. was the economic/military superpower

of the nineteenth century. It was the first country to

have an Industrial Revolution and it built an empire that, by

1900, controlled over one-fifth of the world's land surface

and ruled one-quarter of the world's population. In the

mic-19th century, Britain produced half the world's coal and

iron, half the world's cotton goods, and almost half its

steel, and it dominated international trade. The international

monetary system was centered on the gold standard and the

pound sterling. Now, none of that is still true, and more than

20 countries have higher per-capita GDPs and higher HDIs. The

UK didn't decline absolutely, but relative to the growth of

other countries.

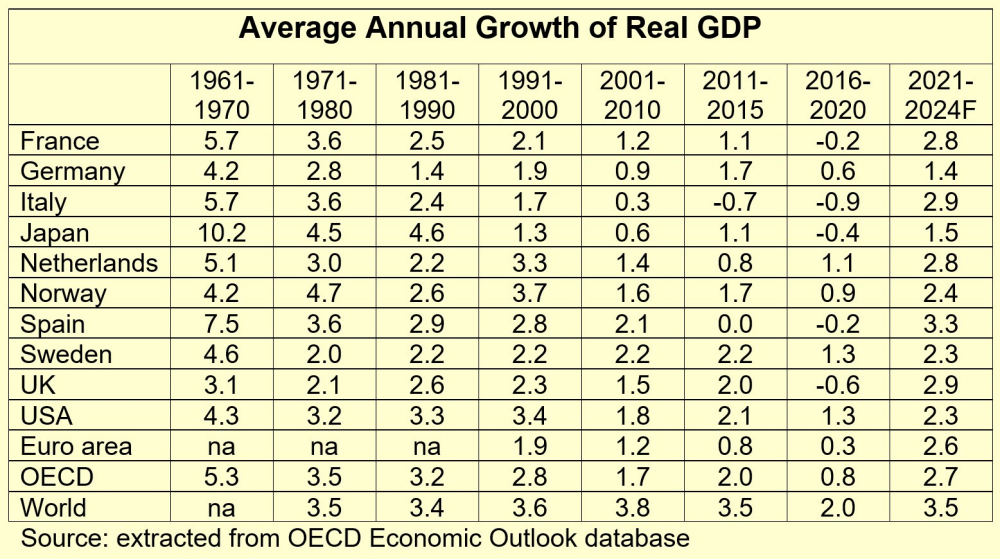

The relative decline seemed to be ending during the years

before the Brexit vote in 2016, but the UK has been a bit

shaky, compared to other OECD countries, since that

decision. Of course, the global market shares of the US,

UK, and other OECD countries is declining relative to China,

India, and other emerging economies).

II. Possible Reasons for

Relative Decline

A. Disadvantages of a head

start - After Industrial Revolution, Britain

saddled with an outdated capital stock.

B. Policy of laissez faire - In 19th C.,

U.S. and others protected key industries and pursued

industrial policies.

C. Military pending, empire, and slavery - This is a huge and complicated

subject. On one side of the ledger, British gains from control

over colonial land, slave trade, and slave ownership

represented a "massive redistribution of the world's resources

from native peoples to Britain."(Daunton)

According to research by Steve Redding at Princeton, about 1/3

of slaves to America were transported on British ships. slave

holding in the Americas contributed 3.5% per year to British

GDP until it was abolished in 1833 (and then the slaveholders,

rather than the slaves, were compensated in in England when

the practice ended). Emigration from England to the colonies

also prevented overpopulation in England. On the other hand,

maintaining the empire became expensive and unsustainable, and

its loss removed those gains. Still, the UK continued to

invest more in the military after WWII than other European

countries (habits die hard).

D. Stop-go fiscal policy

- Alternating unemployment and balance of payments crises.

Hansen found the British government was the only one that

destabilized the domestic economy.

E. High marginal tax

rates - Before Thatcher (in 1976), had 41% avg.

rate (32% in U.S. and 21% in Japan).

F. Sociological problems-

Entrepreneurial spirit dwindled with successive

generations. Labor productivity was stifled by the trade

union establishment. The educational system served upper

classes and de-emphasized natural science, engineering, and

business. Again, the UK has made great progress in those areas

in recent years.

III. The Labor Market and Labor Relations

-

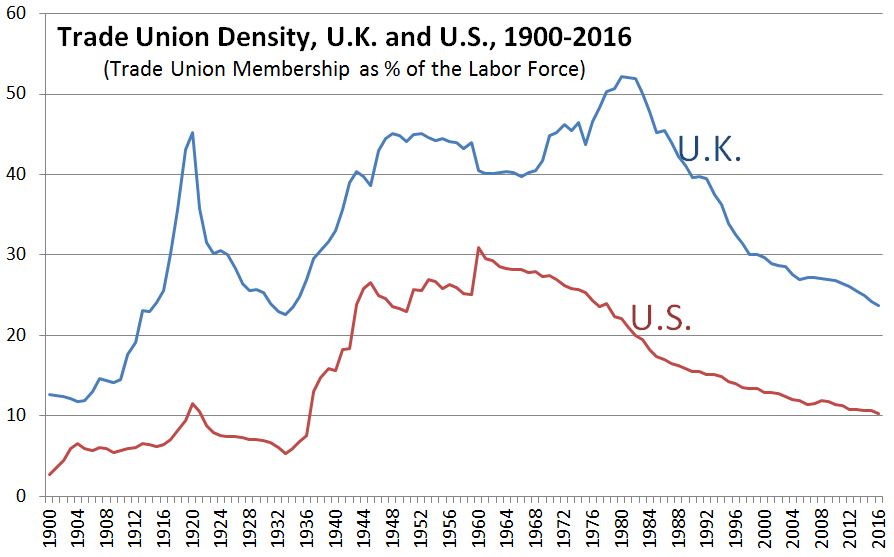

A. Labor Unions

1. Cover about 24% of the labor force, down from a

peak of 52% in 1980. That's much larger than the 10% share in

the U.S. and much smaller than 65% in Sweden.

2. Traditionally, strong political role through

the Labor Party.

3. A strong democratic socialist tradition.

4. All major unions (48 of them) are members of

the Trades Union Congress, often compared to the AFL-CIO in

the U.S. (but the United Auto Workers and the Teamsters have

not always been members of the AFL-CIO)

B. Labor Legislation and Union

Growth -

1. Before 19th century,

Britain maintained strict regulations against union

activities.

2. After 1825,

the unions were given more rights and membership grew

rapidly. The inflation rate, unemployment rate, and

growth of money wages influenced union growth.

3. Thatcher

administration caused reduction in union

membership. Tight monetary policy decreased inflation

and increased unemployment; both discourage unionism.

New legislation required secret ballot elections to approve

closed shops or to approve union action, removal of legal

immunity of union leaders, and reelection of executive

committees every five years.

4. Trade Union Reform

and Employment Bill of 1993 gave workers more

freedom of choice in membership, tightened controls on

elections before strikes, abolished wage councils

(institutions that administered the minimum wage), and gave

women 14 weeks maternity leave and protection from dismissal.

5. Tony Blair, who became Labor PM in 1997,

praised Thatcher “modernization,” but supported return of the

minimum wage.

This was initially controversial, but now the minimum wage

system is supported by the Conservatives and all of the

major parties. Next

month (April 2023) the wage will be adjusted to £10.42

($12.78) for adults aged 25 and over, £10.18 ($12.49) for ages

21-24, £7.49 ($9.19) for ages 18-20, and £5.28 ($6.48) for

ages under 18 and apprentices, and these have been changed

every year. The U.S. federal minimum wage is $7.25 for covered

non-exempt employees, and has been unchanged since 2009

(although some

states, but not Texas and 21 other states, have set

minimum wages as high as $15.74/hour).

IV. Governmental Sector

A. Before World War II, government played small economic

role. During the war, Beveridge Committee recommended

welfare state. The Attlee government established

National Health Service and nationalized Bank of England,

steel, public utilities, and transport. Some programs

terminated by Thatcher, but some remain, such as the National

Health Service and allowances for children.

B. The Nationalized Industries

-

1. Reasons for

nationalization: ideology, national security,

maintain employment, regulate natural monopolies, provide for

external benefits in industries such as health care

2. Problems - Many

of the nationalized industries failed to turn a profit and

required subsidies. However, they were often

nationalized to pursue goals other than profit maximization.

3. Privatization - Beginning

with Thatcher, several industries sold to stockholders.

Some have become profitable. Raised revenue for budget

and created new group of stockholders. Intended to improve

efficiency, reduce costs, and strengthen competitiveness.

Weakened the position of trade unions, because industries were

removed from politics. Critics say that the government sold

the assets too cheaply, that profits are excessive, and that

firms should not be allowed to exercise monopoly power.

Started a revolution of privatizations all over the world.

C. Redistribution of Income and

Wealth - The British tax system is relatively

progressive, and social welfare programs have been accompanied

by a decline in inequality of income and wealth since World

War II. However, the distribution of income after taxes and

transfers is barely more equal than our in the U.S. and is far

more unequal than most of Western Europe..

D.

National

Health Service

- Created in 1948, the NHS is the oldest and largest

single-payer health care system in the world. Doctors paid on

capitation basis. Patient and doctor choice.

Recent reforms are designed to separate public funding from

public control; allow doctors to handle own budgets and

contract with hospitals. In a 2016

survey, the NHS was at the top of the list of "things

that make us proud to be British (50%), ahead of "our history"

(43%) and the Royal Family (31%).

V.

Brexit

- Road

to Brexit

1961 and 1969 The UK applies for EEC membership, but

vetoed by French President de Gaulle both times before his

death in 1970.

1973: UK joins EEC under

Conservative Prime Minister, Edward Heath.

1975: Just two years after

joining, Labour PM Harold Wilson held a referendum on the

question: “Do you think the UK should stay in the European

Community?” 67 percent voted “Yes,” but Labour Party split

over the issue, with the pro-Europe wing splitting from

the rest of the party to form the Social Democratic Party

(SDP).

1988:

Margaret Thatcher "Bruges

Speech": On one hand, "Britain does not dream of

some cosy, isolated existence on the fringes of the

European Community. Our destiny is in Europe, as part of

the Community."

On the other hand, "My first guiding principle is this:

willing and active cooperation between independent

sovereign states is the best way to build a successful

European Community... Europe will be stronger precisely

because it has France as France, Spain as Spain, Britain

as Britain, each with its own customs, traditions and

identity... Some of the founding fathers of the Community

thought that the United States of America might be its

model. But the whole history of America is quite different

from Europe."

2016: Fulfilling a promise to

members of his own party, Conservative PM David Cameron

negotiates new terms for UK/EU relationship (hoping this

would convince voters to vote for "stay"), but 51.9%

supported leaving the EU. Cameron stepped down and Theresa

May (who had also opposed Brexit) became PM.

2018 (November) PM May reaches an

agreement with EU on terms for Brexit, but quickly runs

into opposition in both Conservative and Labour parties.

Biggest issue was/is the "Northern

Ireland Backstop"

The Challenge

1. No hard border in Ireland

2. Agreement that avoids a hard

Brexit

3. Gaining independence from EU product quality and safety

standards.

Theresa May Deal

All of UK remained temporarily in EU customs union

Northern Ireland remained temporarily under EU product

standards.

But this was unacceptable to Brexiteers, and especially to

members of the Democratic

Unionist Party (DUP) of Northern Ireland.

-

2019 Boris Johnson became Prime

Minister in July, and started renegotiating the agreement.

Brexit officially happened on January 31, 2020, but it was

agreed that negotiations would continue during the

following year during the planned transition period. It

started looking like there might be a damaging no-deal

conclusion at the end of 2020, but a last-minute agreement

was reached on Christmas Eve that entered force in 2021.

Key provisions:

-

*

Goods moved without tariffs or quotas between

the UK and EU, but required new inspections and

paperwork, because the UK will not respect all of the

EU quality/safety requirements. Also, sales of

services became more complicated, because professional

qualifications are no longer mutually respected.

*

There was no hard border between Northern

Ireland and the Irish Republic, but, to avoid that,

Northern Ireland had to continue following many of the

EU rules, and new checks were introduced on goods

entering Northern Ireland from the rest of the UK. The

DUP and other unionist groups declared that Boris

Johnson had

betrayed them, raising the possibility

that the two parts of Ireland may be united in the

future.

*

Freedom to work and live between the UK and the EU

comes to an end, and UK nationals now need a visa to

stay in the EU more than 90 days in a 180-day period.

-

*

The UK would be free to negotiate its own trade

deals with the U.S. and other countries.

-

2022 (September) Boris

Johnson loses office, partly because of parties

during COVID lockdown, and was followed by Liz

Truss, who was immediately unsuccessful (served only

7 weeks) after submitting a "mini-budget" with large

borrowing and tax cuts, causing financial

instability.

2022 (November) Rishi

Sunak became prime minister. In February 2023, he

and Ursula

von der Leyen announced a "Windsor Framework." It

would:

-

*

Simplify the movement of goods crossing the

Irish Sea from Great Britain to Northern

Ireland. Goods being sent for final sale in

Northern Ireland would be subject to less

inspection and paperwork than goods destined for

the EU Common Market.

-

*

Some EU law would apply in Northern Ireland, but

Sunak said "the only EU law that applies in

Northern Ireland under the framework is the

minimum necessary to avoid a hard border with

Ireland and allow Northern Irish businesses to

continue accessing the EU market"

-

* The

Northern Ireland Assembly in Stormont can pull

an "emergency brake" if it disagrees with an EU

goods law which "would have significant, and

lasting effects on everyday lives."

- Yesterday

(3/22/2023), Parliament approved he Windsor

Framework by a vote of 515 votes to 29, but it was

opposed by the DUP that said the "Stormont

Brake" needs to be strengthened, and it was also

opposed by former prime ministers Boris Johnson and

Liz Truss who said it means "the whole of the UK"

will be unable "properly to diverge and take

advantage of Brexit".

Impact

of Brexit

Now that Brexit is happening, what is its significance? Time

will tell, and it's difficult to untangle the results of

Brexit from the results of COVID, but overall the results are

not as positive as promised or as disastrous as some

predicted. Here are some of the early indications:

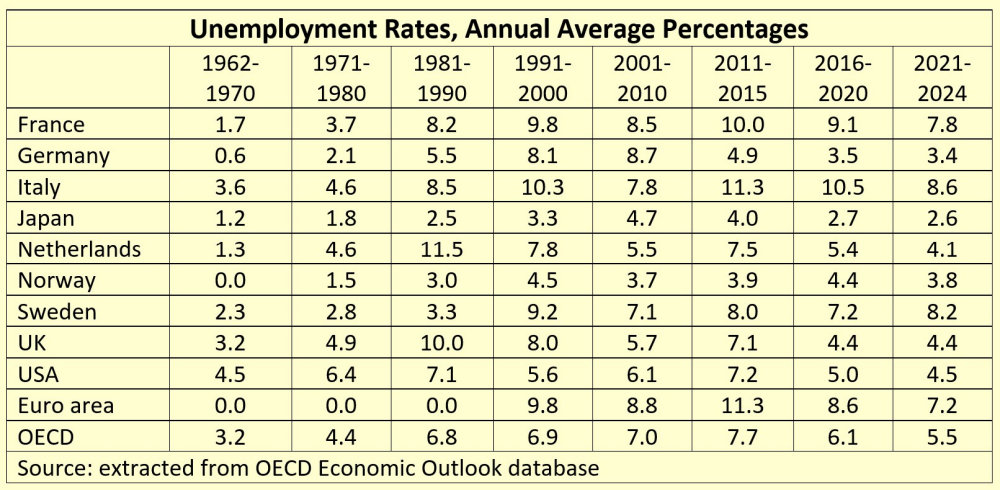

1.

GDP growth was negative during 2016-2020 (while it was

positive in the Euro area), but it seems to be recovering and

unemployment has remained stable. But this is

underperformance compared to what was promised by the

Brexiteers.

2.

Trade in goods with the EU fell sharply after the

Brexit transition period ended, with UK imports from the EU

dropping by approximately 25 per cent more than UK imports

from the rest of the world, a trend which persisted throughout

2021.

3.

Potentially, trade in services may be a bigger problem

than trade in goods, because they are not covered by the

so-called "trade and co-operation agreement" (TCA), and they

represent the faster-growing part of British exports. The

impact on financial services was already noted above - 44% of

British financial services firms had moved or planned to move

operations and/or staff to the EU. According to The Economist,

"Musicians, actors, fashion designers and professional-service

firms are griping about expensive red tape and travel

restrictions."

A 2022 scandal involved P&O Ferries, a British company

that operates ferries from the UK to Ireland and the

European continent. P&O laid off 800 of its workers (and

removed some of them forcefully from the ships), telling them

that the ships would now be “primarily crewed by a third-party

crew provider.” Critics have charged that Brexit, which was

supposed to protect the UK from requirements to accept

European workers, has instead weakened enforcement of UK labor

laws, making it easier to replace British P&O workers with

“cheap agency workers from eastern Europe.”

4.

The UK has an opportunity to review its regulations,

and end some of those that were imposed by the EU. However,

The Economist predicts that divergence from EU

structures will be minimal, because (a) the trade deal that

was reached in December 2020 requires the UK to stay close to

European norms in order to stay in the free-trade area, (b)

"Britain shaped European law" and "EU rules have become de

facto global standards" in many sectors and (c)

divergence from EU norms in England while Northern Ireland is

forced to follow them would exacerbate the England/Ireland

divide. According to Philip Hammond, a former Conservative

chancellor, "Britain has paid a fantastically high price for

an autonomy it won’t use."

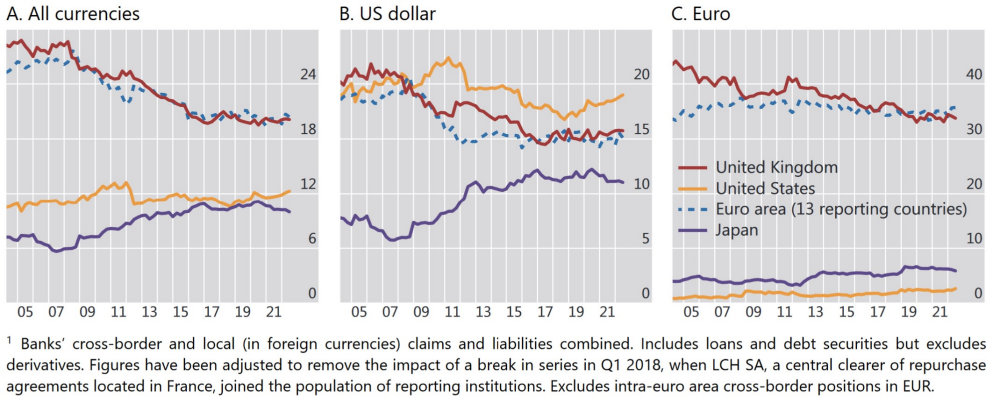

4. Financial sector - London has

been the world's most important center for international

lending, insurance, shipping contracts, and trading of gold

bullion, Eurocurrencies, and Eurobonds, and has the third

largest stock market. Bank of England independence was

granted by Labour (opposed by Tories) in 1997.

There was considerable concern that Brexit would damage the

UK's position as a financial center. According to our

assigned reading by Perri, "The financial sector will be the

most damaged in the case of Hard Brexit because it is easy

to leave for financial institutions, insurances, banks, and

multinationals that are operating in London (until now) to

take advantage of the low taxation rate." Between the 2016

Brexit vote and the end of 2021, EY

reported that 44% (97 out of 222) of British financial

services firms had moved or planned to move operations

and/or staff to the EU. Also, 24 financial services firms

declared they would transfer over £1.3trn of UK assets to

the EU and the Bank

of England reported that 7,500 jobs have been lost in

the financial sector and the fallout may continue for

several years.

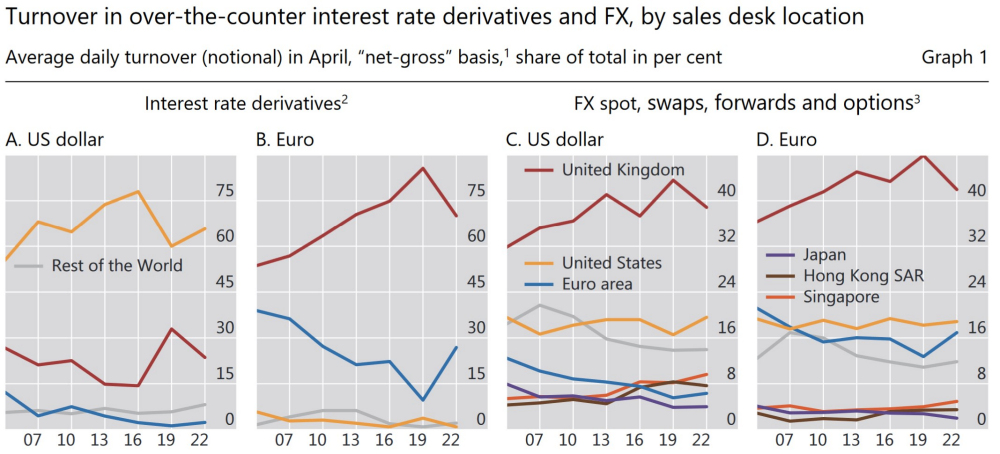

Despite all that, a December

2022 report by the Bank for International Settlements

(BIS) declares that "London has retained its

pre-eminence as an international financial center," and its

role has eroded only marginally. Here are a couple of charts

from that report:

5.

Public Opinion. In 2016, Brexit was adopted

with relatively weak support - 51.9%. That result was driven

largely by older voters, and especially by those in rural

areas. Surveys

indicate that 64% of voters over 65 voted to leave,

while the youngest category, 18- to 24-year olds, voted by 71%

to remain.

According to YouGov

polls in the UK, the percentage who believe it was a

mistake to leave has been steadily rising for about two years.

Now, 54% say it was wrong to leave, 33% say it was right, and

13% say they don't know. A large part of that shift is not a

change in individual opinions, but entry of younger people

into the pool. Among those born before 2004, 64% say that

Brexit was a mistake, but they were too young to vote in 2016.

|