|

The

United States: The Service Economy

I.

The Environment

A.

Large size and rich natural

resources--7% of world land area for 5% of

world's population. Gavin Wright—resource abundance made

major contribution to industrialization between 1890 and 1940.

B.

"Melting Pot" Culture

-- Benefit: Complementary skills. Cost:

Discrimination and rivalry.

C.

Philosophy of Individualism

-- belief that individuals can have significant impact on

society; success through individual hard work and

frugality.

Reflected in many of our institutions: local voting systems,

college accreditation, movie rating systems, etc. Encourages

experimentation, innovation, entrepreneurship. Discourages

welfare spending. Made it difficult to impose health protocols

that kept other countries safer during Covid.

II.

The Changing Structure of the Economy

A.

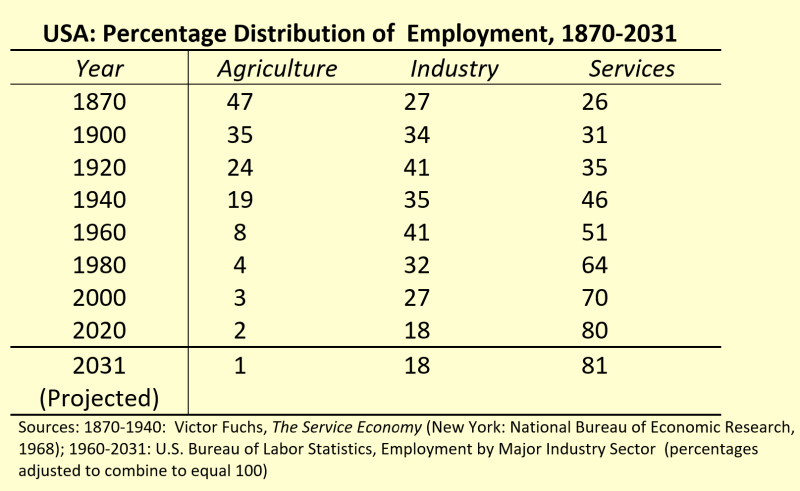

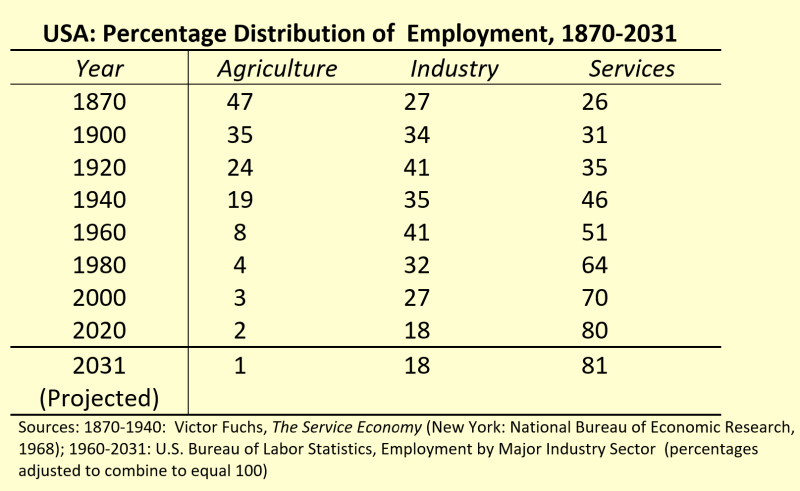

Agriculture most

important employment sector until 20th century. Large

agricultural exporter during the French Revolution and

Napoleonic wars. Industry

dominated employment only from 1900-1930.

B.

The Service Sector -

Employs about 80% of the United States labor force,

projected to rise to 81% by 2031. Several subsectors of

services (business services, health care, state/local

government, leisure/hospitality, and retail trade) already

employ more people than all of manufacturing. Now there are

more people in business/professional services, alone,

than in all of the goods producing sector (mining,

construction, manufacturing, and agriculture), and by 2031

that will also be true of health care.

See projections

to 2031.

1.

Causes of growth

a.

income growth - climbing up Maslow's hierarchy of needs

b.

global competition and changing comparative advantage

c.

productivity growth differential—slow productivity growth in

service sector requires larger share of labor, higher

current prices

d.

labor supply—women’s preferences

2.

Significance

-

a.

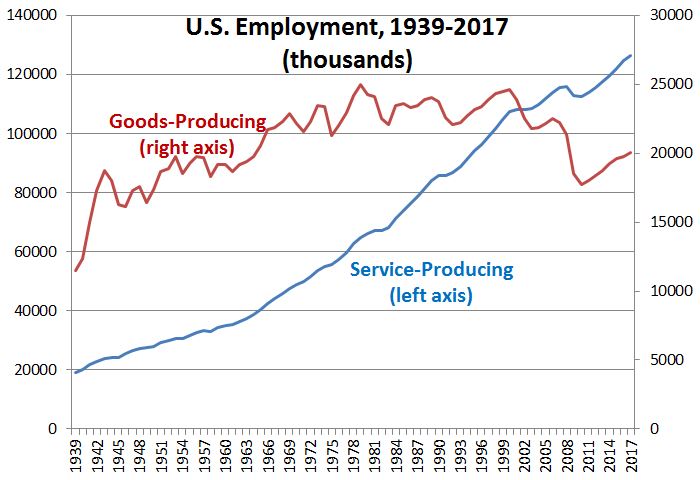

Productivity - Growth is

relatively slow in services, so rising service share has

caused overall slowdown and higher inflation

(illusion?).

b.

Stability - Has increased the

stability of output and employment. Service employment

has risen almost every year, aside from downturn during the

2009-2010 Great Recession. Stable,

perhaps because:

i.

higher percentage of self-employed workers.

ii.

flexible incomes (piece work or commission).

iii.

no inventories.

iv.

government services stable.

c.

Positive contribution to balance of payments. See

Data.

d.

Labor and income distribution -

Many people are self employed and few are unionized.

Service sector growth apparently contributes to income

inequality.

III.

Industrial Organization

-- At the end of the Civil War, the age of big

business began. Today, concentration in U.S. is

comparable to levels in France, W. Germany, Italy, Japan and

the U.K. Shepherd found that the share of national

income originating in "effectively" competitive industries

increased significantly between 1958 and 1980. More

recent research by Abdel-Raouf suggests that the

effectively competitive share of the U.S. economy continued to

grow to through 1997, and monopolies fully disappeared. Since

that time, however, Grullon,

Larkin and Michaely find that the trend has reversed,

and more than 75% of US industries have experienced an

increase in concentration levels over the last two decades.

They blame lax enforcement of antitrust regulations and

increasing technological barriers to entry. In the past,

concern about concentration was focused on the railroads and

manufacturing - now it has shifted to Amazon, Facebook, and

other technology firms.

IV.

The Labor Market—U.S. unemployment

has been lower than European during most years since 1982. At

the end of 2019, the U.S. rate was 3.5% when the EU rate was

6.3%.

Why? Smaller wage increases, flexible labor market.

Union membership declined from 27% in 1950s to about 11% in

2020. Furthermore, union members accounted for about 35% of

public-sector workers in 2020, but only 6.3% of private-sector

workers. (Source)

A. Why decline of unionization?

1.

Service sector, self employment.

2.

Job satisfaction.

3.

Employer resistance.

4.

Government substitution.

B.

Have unions increased wages at expense of profits or at the

expense of nonunion wages?

V.

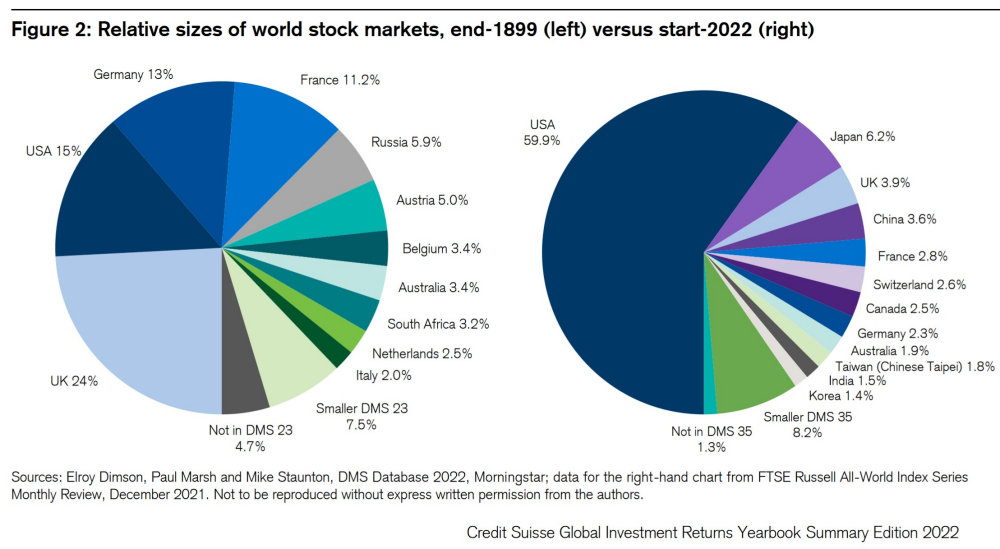

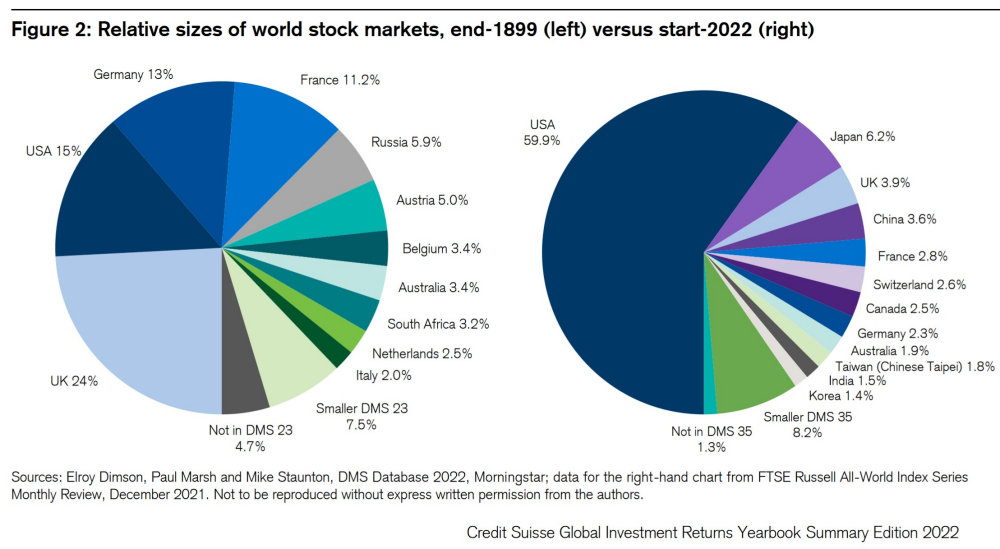

The Financial Sector --

Well-developed financial markets. Dual banking system with

gradual strengthening of central bank (Federal Reserve created

in 1913; gained control of reserve requirements for all

federally insured depository institutions in 1980. U.S. equity

markets are dominant in the world:

https://www.credit-suisse.com/media/assets/corporate/docs/about-us/research/publications/credit-suisse-global-investment-returns-yearbook-2022-summary-edition.pdf

and

the U.S. Dollar has declined

in its near monopoly as the major reserve

currency, but is still in a commanding

position. That's one of the main reasons that the U.S.

runs international trade deficits - other countries want to

sell goods to us to obtain Dollars, not to buy U.S. goods, but

to hold reserve balances (savings accounts) and to buy good

from other countries that also want to hold Dollars.

VI.

The Governmental Sector --

Federal/State/Local division of labor. Relatively

non-interventionist.

A.

Regulation - How much safety do we want? Banks?

B.

Fiscal and Monetary Policy -

Normally, the national budget is prepared and proposed by the

executive branch; examined, amended, and approved by the

Congress; and signed into law by the President. Monetary

policy is set by the Federal Reserve, insulated from political

pressure. No formal use of indicative planning or

industrial policy.

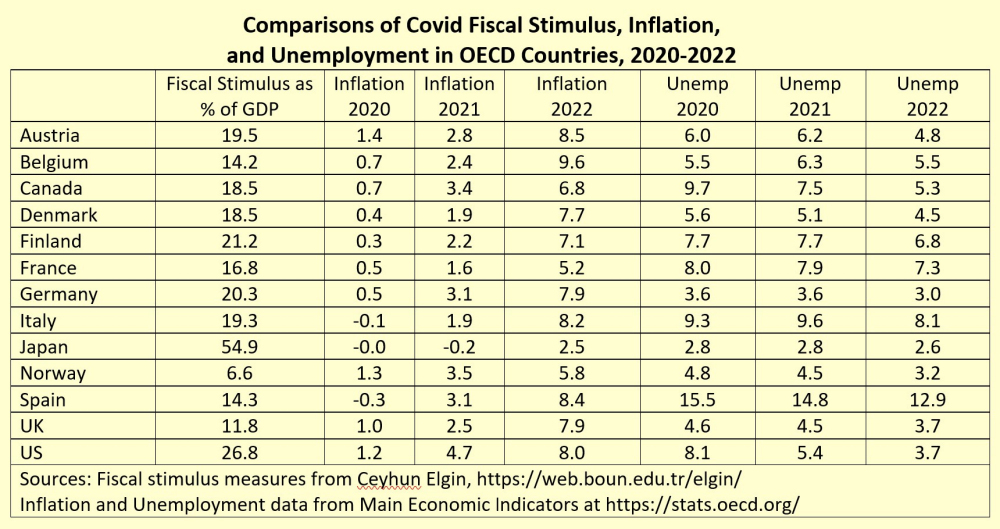

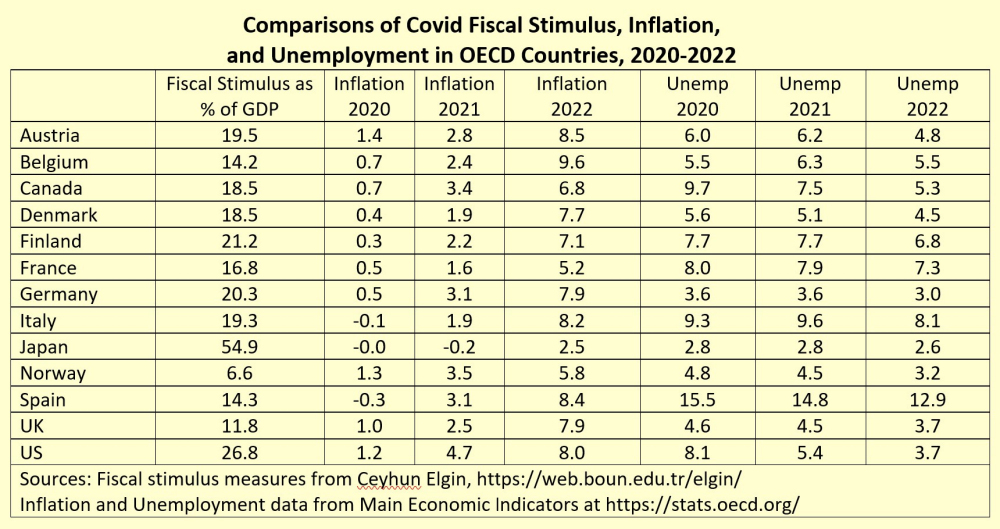

During the past couple of years, there's been a continuing

debate over the sizes of the Covid relief bills that were

passed by Congress and whether they were the cause of our

higher rate of inflation (or whether it's caused more by

supply disruptions. In the comparative data below,

there's little correlation between Covid fiscal stimulus

programs and acceleration of inflation. The relationship may

be a bit stronger with reduction of unemployment.

C. Distribution of Income

- relatively unequal compared to other industrial

nations. Resistance to governmental

redistribution.

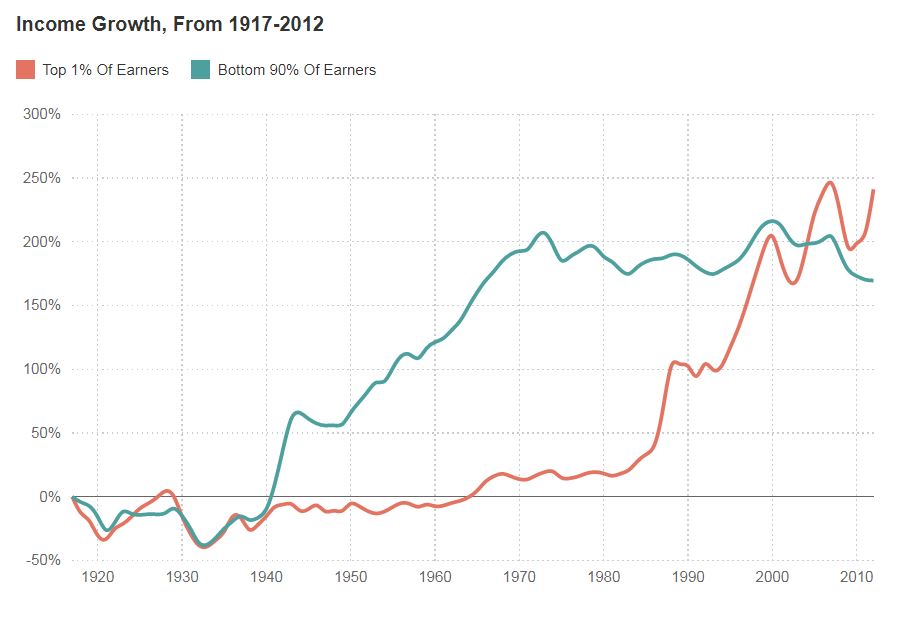

Two phases - 1940s-1970s, rising incomes of bottom 90%, and

then decline. Since 1980s, rise of the top 1%.

Source

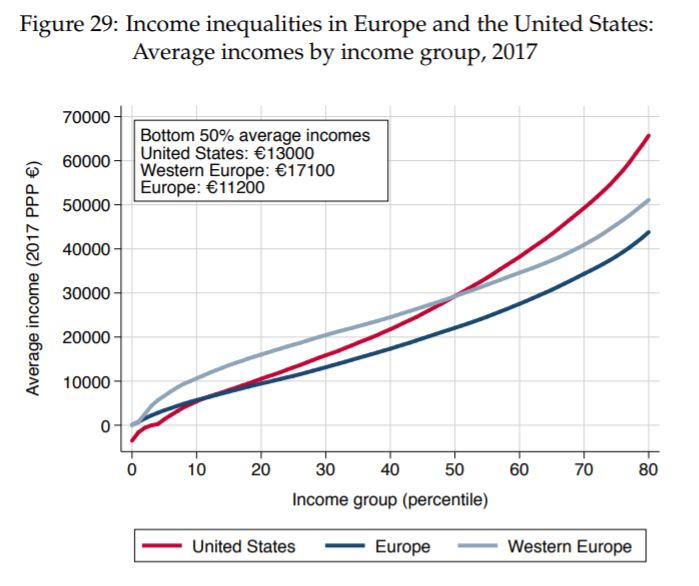

According to recent

work by Blanchet, Chancel, and Gethin, the average

income level in the U.S. (at PPP) is higher than in Western

Europe, but average incomes of the bottom half of the income

distribution are lower in the U.S. than in Western Europe.

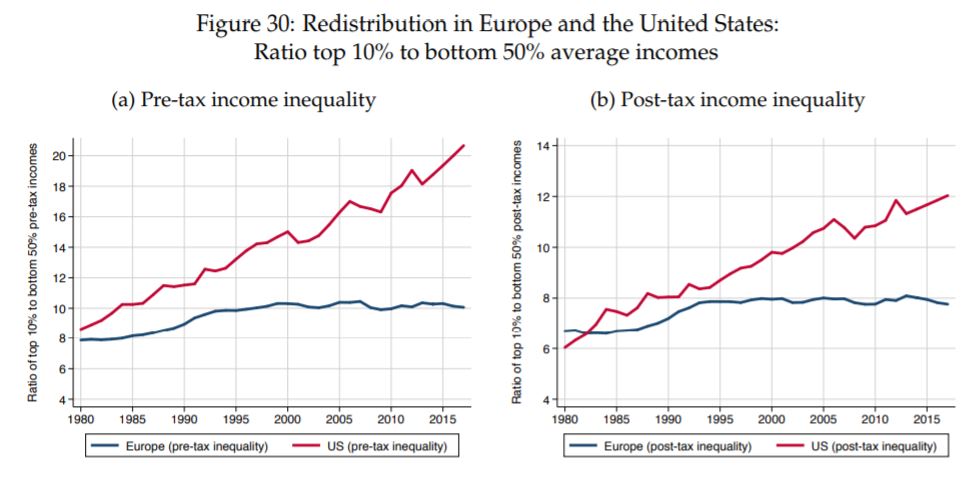

That's true, despite the fact that the U.S. tax system seems

to do more to level incomes than European taxes do:

Their conclusion is that Europe relies more on

"predistribution" - investments in health care and education,

effective antitrust laws and labor-market regulations, and

relatively strong labor unions - and the U.S. relies more on

"redistribution" - progressive taxes (which have grown less

progressive) and transfer payments.

|