|

Economics of the Developing World

I.

Who Are the Poor?

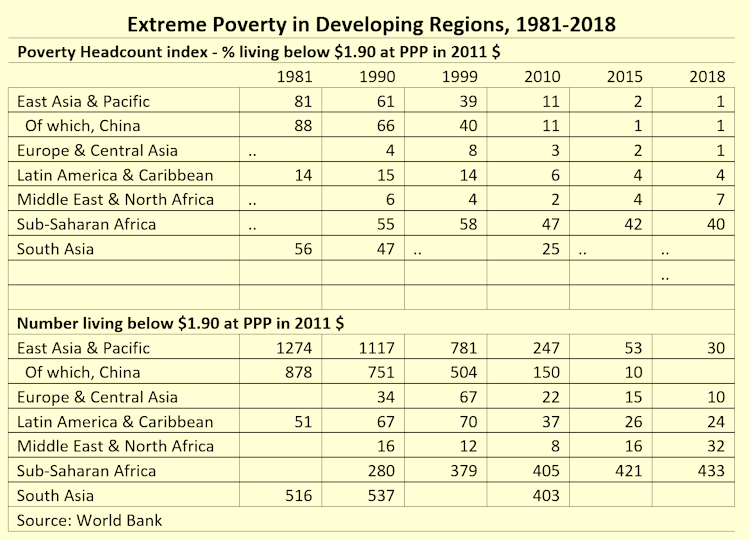

Concentrated

in Sub-Saharan Africa, India, and elsewhere in South Asia. The

Chinese poverty rate was much higher than the developing

country average in 1990, but already much lower than average

in 2005. Income and literacy rates are relatively high in

Latin America, but poverty rates are also high because incomes

are distributed unevenly. With the exception of Sub-Saharan

Africa, all regions met their

Millennium Development Goal of reducing poverty by 50

percent from its 1990 level by 2015. In 2015, the new

Sustainable Development Goals were adopted, calling on nations

to "eradicate extreme poverty for all people everywhere" by

2030. World

Bank projections make it clear that progress toward that

ambitious goal has been interrupted by the COVID-19 crisis.

II.

Obstacles to Development

A. Introduction -

To grow, a country must produce an output beyond its

subsistence needs, and must invest that surplus in productive

means rather than in extravagant consumption, the military, or

civic monuments, or transferring it abroad.

B.

Physical Environment and

Demography- The average developing country has

half the arable land per capita of industrial countries. Most

poor countries are located in tropics, with extremes of heat,

rain, and insects.

Recent research by Spolaore and Wacziarg in JEL finds

that a small set of geographic variables (absolute latitude,

the percentage of a country’s land area located in tropical

climates, whether the country is landlocked or an island) can

account for 44 percent of contemporary variation in log per

capita income, with quantitatively the largest effect coming

from absolute latitude. they also find that countries using

the most advanced technologies in the year 1000 B.C. tend to

remain the users of the most advanced technologies in 1500 and

today, particularly if we correct for their populations’

changing ancestry.

C.

Culture - Economic

development is supported by cultural norms that encourage

honesty, trust, cooperation, hard work, saving (delayed

gratification), honesty, gender and racial equality, and

peaceful resolution of problems. These norms can be

influenced by geography (i.e., separation of people by rivers,

mountains), climate (ability to engage in hard labor), history

(experience with colonialism, slavery, etc.), religion, and

other factors. We have seen recent research by Joseph Henrich

on the religious influence on marriage customs, reducing

tribalism, and strengthening trust and cooperation. Some

"cultural determinists" have noted that most high-income

nations are predominantly Christian or Confucian. They blame

problems of Latin America on an authoritarian culture and

strict brand of Catholicism imported from Spain. Aspects of

Hinduism, such as caste system, may have complicated

development in South Asia, and aspects of Islam, such as the

legal and finance systems, may have slowed the Middle East.

D.

The Economic System -

Some institutional structures retard development. In

many poor countries, absence of fair and effective legal

institutions. Limited monetary exchange. In much

of Africa and Asia, land is held in common or worked on a

sharecropping basis; poor incentive for improvement.

Limited

quality and quantity of financial intermediation in

many developing countries, usually organized around a few

large, heavily regulated banks. Securities markets are

rudimentary. Interest rates are controlled and taxed; provide

small incentive for saving.

E.

Vicious Circles of Poverty

- The population in a poor country cannot afford to invest in

capital goods, education, and health programs that are needed

to promote development. Also, poverty breeds crime,

political instability, and excessive population growth, which

perpetuate poverty..

NOTE:

Jeffrey Sachs of Columbia University has pointed to another

vicious circle. Scientific research tends to follow

market demand, so the technological needs of developing

countries (malaria and AIDS vaccines, tropical biotechnology,

etc.) are neglected. Solution: guarantee a market to

technology firms for developing country needs.

F.

Colonialism, Imperialism, and

Dependency - Most would agree that colonial

rule was often exploitive - even the American Revolution was

prompted by exploitive British taxes. Some would argue

that foreign investment and trade are also exploitive and

promote "dependent development."

UPDATE: According to the research

by Acemoglu, Johnson, Robinson, Europeans adopted more

exploitive, extractive institutions in countries where the

physical environment and health conditions made it difficult

for them to settle. These institutions persisted, they

say, through the years, and now explain approximately

three-quarters of the income per capita differences across

former colonies. Once they control for the effect of

institutions, they find that countries in Africa or those

farther away from the equator do not have lower incomes.

III.

Development Strategies

A.

Laissez Faire vs. Intervention

-- Adam Smith argued that economic

progress is natural. Governments should maintain peace,

sanctity of contracts, administration of justice, and public

projects. Excessive interference will stop economic progress.

In 1940s and 1950s, Ragnar Nurske argued

that growth was stalled by "vicious circles," and Paul

Rosenstein-Rodan argued that a "big push" was

necessary to provide minimum speed or size of investment for

sustained development.

NOTE: As an alternative to the “big push,”

micro-credits:

In 1976, the Bangladeshi economics professor Muhammad Yunus

tried an experiment. From his pocket, he lent the equivalent

of $26 to a group of 42 workers. With that 62 cents per

person, they bought the materials for a day’s work weaving

chairs or making pots. They soon paid back the loan, and Yunus

went on to establish the Grameen

Bank, which launched the microcredit revolution.

In 2006, the Bank and Yunus were awarded the Nobel Peace

Prize, and microfinance has spread throughout the world.

However, the effectiveness of microfinance and many other

micro-interventions (such as distribution of textbooks) has

been called into question by some of the research of Michael

Kremer, Esther Duflo, and Abhijit Banerjee who received the

2019 Economics Nobel for their work on Randomized Controlled

Trials (RCTs) in economic development studies. See our article

by Seema

Jayachandran, describing their work on remedial

education.

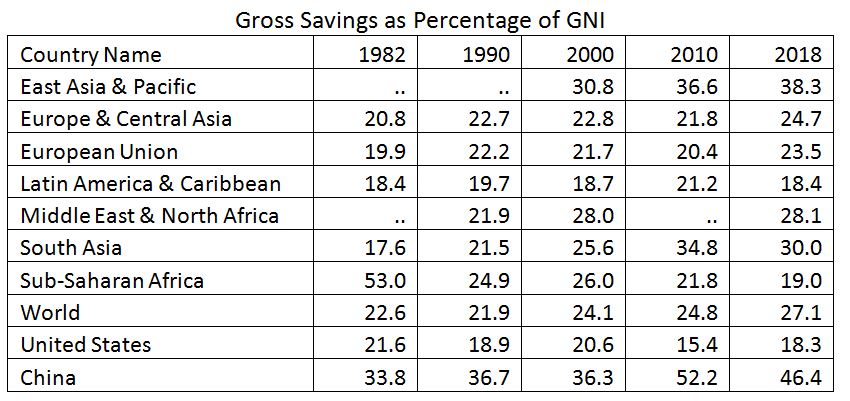

On the other hand, the micro-approach of both Yunus and

Kremer/Duflo/Banerjee is criticized by Yao

Yang, who points out that economic growth ultimately

relies on the large-scale savings and investments that were

discussed by earlier authors.

B.

Balanced vs. Unbalanced Growth

-- Nurske argued industrialization requires balanced growth in

all sectors for production balance and because of Say's

Law--the demand for one product is generated by the production

of others. Walt Rostow argued for

unbalanced development of "leading sectors" and Albert

Hirschman emphasized importance of sectors with strong backward linkages (required

industrial inputs) and forward linkages (produces important

industrial inputs).

C.

Import Substitution and Export

Promotion - What industrial sectors should

develop first? Perhaps, begin with products with

demonstrated domestic demand--import substitution.

Hopefully, will reduce payments imbalances, but

distorts allocation of resources and reduces benefits of

comparative advantage. Invites bribery and corruption. Import

reduction decreases demand for foreign currency, raises the

exchange rate, and makes it difficult to market exports.

Instead, export promotion keeps

the nation open to foreign trade, encourages efficiency,

reaps benefits of international specialization, and

imposes cost on inflationary policies and overvalued

exchange rates. On

the other hand, it may increase dependence on foreign trade

(vulnerability to trade wars) and create enclave of exporters

with weak links to the local economy. Part of Washington

Consensus.

UPDATE: Thomas Friedman argues that

Globalization 2.0 was the era of "Reform Wholesale," which

emphasized the top-down macroeconomic provisions of the

Washington Consensus:

- Privatization

of state-owned companies

- Deregulation

of financial markets

- Exchange

rate liberalization

- Openness

and encouragement of foreign direct investment

- Reduction

of trade barriers

- Introduction

of more flexible labor laws

He argues that these are still necessary,

but not sufficient. The flat world of Globalization 3.0

calls for "Reform Retail" which involves a detailed

microeconomic analysis of infrastructure, regulatory

institutions, education, and culture.

UPDATE: Justin Yifu Lin was born in Taiwan, defected to

mainland China (swam from Kinmen Island to Xiamen) in 1979,

later earned a PhD in economics at U. Chicago, returned to

China to teach at Peking University, and served as chief

economist of the World Bank from 2008-2012. Today, at Peking

University, he is Dean

of the Institute of New Structural Economics, which

"maintains that developing countries or regions should

develop industries that conform to their comparative

advantages based on their factor endowments structure. It

seeks synergies between an effective market and a

facilitating government in an effort to achieve economic

transformation and upgrading as well as economic and social

development." In other words, unlike the Washington

Consensus, NS emphasizes that developing countries need to

have robust governmental involvement to address market

failures. With the right mix of policies, Lin has argued,

"Every developing country has the potential to grow

continuously at 8% or more for several decades, and to

become a middle-income or even a high-income country in one

or two generations…".

|